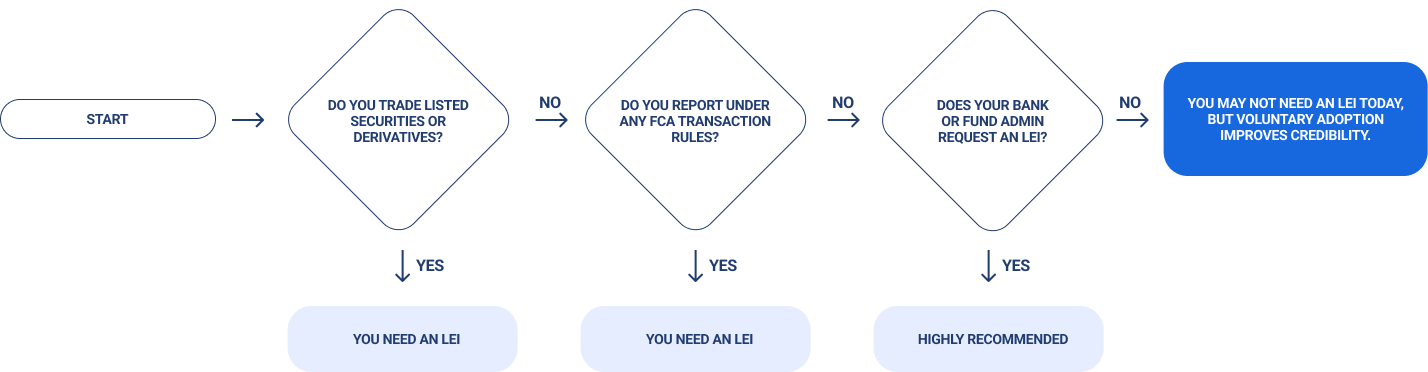

Find out in two minutes whether your organisation must hold an LEI number to trade, report or open bank accounts.

If your UK business trades listed shares, bonds, ETFs, FX forwards, interest-rate swaps or engages in repo/securities lending, you need an Issued LEI number. If you don’t trade – but plan to open a custody or clearing account—banks will likely request an LEI anyway.

If your UK business trades listed shares, bonds, ETFs, FX forwards, interest-rate swaps or engages in repo/securities lending, you need an Issued LEI number. If you don’t trade – but plan to open a custody or clearing account—banks will likely request an LEI anyway.

| Regulation | Instruments covered | Entity types | Enforcement date |

|---|---|---|---|

| MiFID II Art 26 | Shares, bonds, ETFs | Investment firms & clients | Jan 2018 |

| EMIR & EMIR-REFIT | OTC & ETD derivatives | Financial & NFC entities | Jun 2014 / Jun 2020 |

| SFTR (EU & UK) | Repos, securities lending | Borrower & lender | Jul 2020 |

| CSDR | Settlement fails reporting | CSD participants | Feb 2022 |

| Dodd-Frank (US) | Swaps | US counterparties | Apr 2013 |

UCITS and AIFs must maintain Issued LEIs for all fund compartments. FCA Handbook COLL 6.9 cites LEIs in risk disclosures.

Any LTD entering an FX forward exceeding seven days qualifies as a derivative counterparty under EMIR and therefore needs an LEI.

Council treasurers using repo lines with UK banks must maintain active LEIs per SFTR-UK.

| Task | Link |

|---|---|

|

First-time registration

|

Register an LEI in 2 min |

|

Check your status

|

Free LEI lookup |

|

Renew or update data

|

Renew / update LEI |

|

Transfer for lower fees

|

Transfer LEI for free |

Around 191 000 as of Q2 2025 (GLEIF statistics).

Only if it trades reportable instruments, but UK fund LPs usually do.

Yes. Each legal entity requires its own LEI; group LEIs don’t cascade.

Encourage voluntary registration; banks increasingly ask suppliers for LEIs in trade-finance deals.

No. Regulations specify Issued status; lapsed codes are rejected.

Not yet under UK law, but MiCA in the EU may reference LEIs for crypto-asset service providers.

Highly experienced professional accountant with over forty years involvement in regulated finance and accounting positions in both private and publicly listed companies in Australia, the United States and the United Kingdom.

Dr Healy has worked as employee, partner, consultant, company secretary and director in a number of firms and multi-national entities across diverse industries holding CFO, Finance Director, CEO and Chairman positions.

Darko brings over 20 years of deep technical expertise to Global Compliance, with a background in infrastructure design, cybersecurity, and artificial intelligence. He’s built scalable platforms for financial services, logistics, and SaaS businesses, and has been at the forefront of applied AI for over a decade.

With more than 15 years in executive leadership at public companies, Robert has driven IPOs, major M&A deals, and cross-border expansion in sectors like iGaming, fintech, and digital media. His leadership is built on real-world compliance experience, a passion for transparency, and a deep understanding of operational scaling in regulated industries.

Polina is a seasoned expert in corporate governance and compliance, with extensive directorship experience across the UK and Europe.

She has led governance and regulatory frameworks in the health-tech, med-tech, and financial services sectors — ensuring transparency, accountability, and adherence to industry standards.

Her career includes senior roles at:

In these positions, she has overseen compliance, risk management, and international corporate expansion.

Beyond corporate leadership, Polina is an entrepreneur — the founder of a regulated aesthetics franchise and an investor in cross-border property development.

Fluent in English, Bulgarian, Spanish, and Russian, she combines strong technical expertise in compliance and governance with the ability to navigate complex international business environments.